For the seventh year in a row, Media daily publishes data on the revenues, profits, and number of employees of the 20 largest telecom operators in the region, so in this exclusive analysis, the data for the year 2023 is in order.

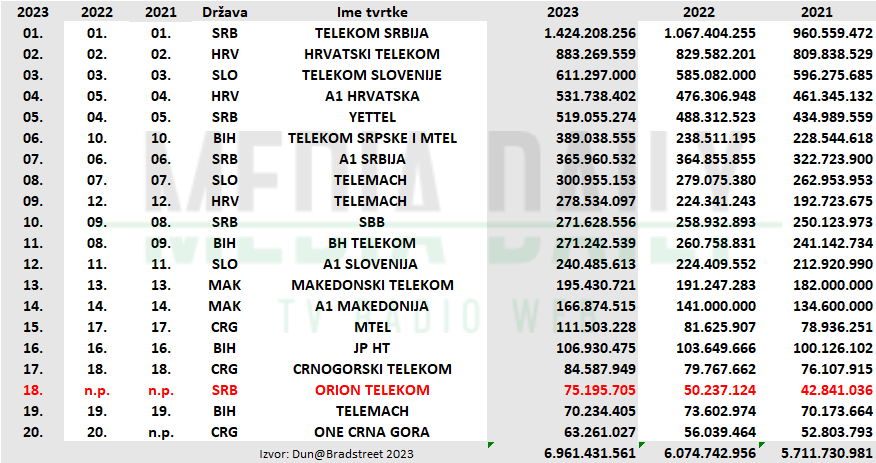

The total revenue of the 20 observed telecoms from Slovenia, Croatia, Bosnia and Herzegovina, Serbia, Montenegro, and North Macedonia increased by as much as 887 million euros compared to 2022 and now cumulatively amounts to 6,961,431,561 euros. Slovenian T-2 Telecom, which was in 15th place in 2022, is not on this year’s list, because it was the only one for which we were unable to obtain data on financial operations in 2023, even though we contacted their press service three times.

Telecom Serbia is the undisputed telecom king of the region and after having revenues of more than one billion euros for the first time in 2022, in 2023 it increased this even more significantly to a dizzying 1,424,208,256 euros. As much as 541 million euros, Telecom Serbia has higher revenues than the second-ranked Croatian Telecom, until 2020 the largest telecom in the region, which is owned by the powerful Deutsche Telecom.

Third-placed Telecom Slovenia only slightly increased its revenues in 2023 and has generally been stagnant for some time, but that’s why A1 Croatia increased its revenues and jumped to fourth place, overtaking Serbia’s Yettel.

Both Telecom Srpska and Mtel made a big jump in revenue, which resulted in a jump of as many as four places on the list, and the same thing was done by the owner-linked Mtel Montenegro, jumping from 17th to 15th place.

We also note a large increase in the income of Telemach Croatia, which therefore jumped from 12th to 9th place.

New to the list is Orion Telecom from Serbia, which took 18th place.

The ranking of all 20 telecom companies according to revenues in 2023, with comparative amounts for 2022 and 2021, can be found in the following table. All amounts are in euros.

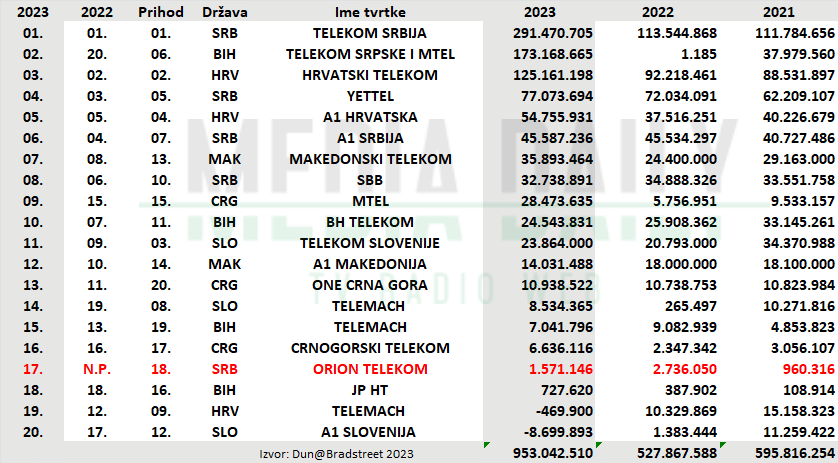

The total profit of the observed 20 telecom operators increased significantly compared to 2022 by 426 million euros and cumulatively amounted to 953,042,510 euros. Two companies operated with a loss, A1 Slovenia and Telemach Croatia (in 2022, they were all in the red).

Telecom Serbia (TS) has by far the largest profit, and its daughter company – Telecom Srpska and Mtel – jumped to second place. The total profit of these two telecoms is almost half of the profit of all other 18 telecom operators, and if Mtel Montenegro‘s profit is added to this group, then more than 50%.

Croatian Telecom also had a serious profit, now in third place, and fourth Yettel, and fifth A1 Croatia. Symbolic gains were made by Orion Telecom and JP HT.

The ranking of all 20 telecom companies according to profit in 2023, with comparative amounts for 2022 and 2021, can be found in the following table. All amounts are in euros.

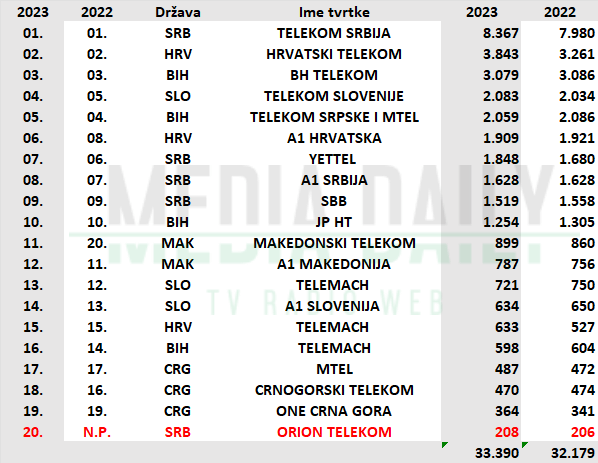

Last year, the total number of employees increased by 1,211 and now the top 20 telecom operators have 33,390 employees.

Telecom Serbia has the most employees, followed by Croatian Telecom and BH Telecom, and One Montenegro and Orion Telecom have the fewest.

The ranking of all 20 telecom companies according to the number of employees in 2023, with comparative data for 2022, can be found in the following table.

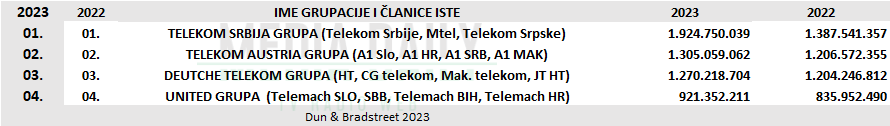

At the end of the analysis, when you look at the total revenues according to ownership groupings, you can see a huge increase in the revenues of the Telecom Serbia Group, which has become unattainable for other telecom groups.

The Telecom Serbia group has 619 million euros more revenue than the second-ranked A1 group. Deutsche Telecom Group (DTG) is third, and telecom operators United Group is fourth.

A total of 15 out of 20 companies are connected in ownership groups. Here is a table with comparative data for 2023 and 2022.

Slovenia

Slovenia

Europe

Europe

Bosnia and Herzegovina

Bosnia and Herzegovina

Croatia

Croatia