Media daily has been monitoring and analyzing the financial data of the largest telecoms in Serbia and the region for eight years, from which very interesting comparisons can be seen over the long term, especially whether good managerial decisions and assessments were made in the past that ultimately should have enabled increasing revenue and profit, which is the goal of every successful company.

We, therefore, decided to compare the four largest telecom operators in Serbia and graphically show their revenue growth over eight years. The data are impressive, especially for the largest one – Telecom Serbia, and not only in Serbia but also when we compare certain data in the entire ex-yu area.

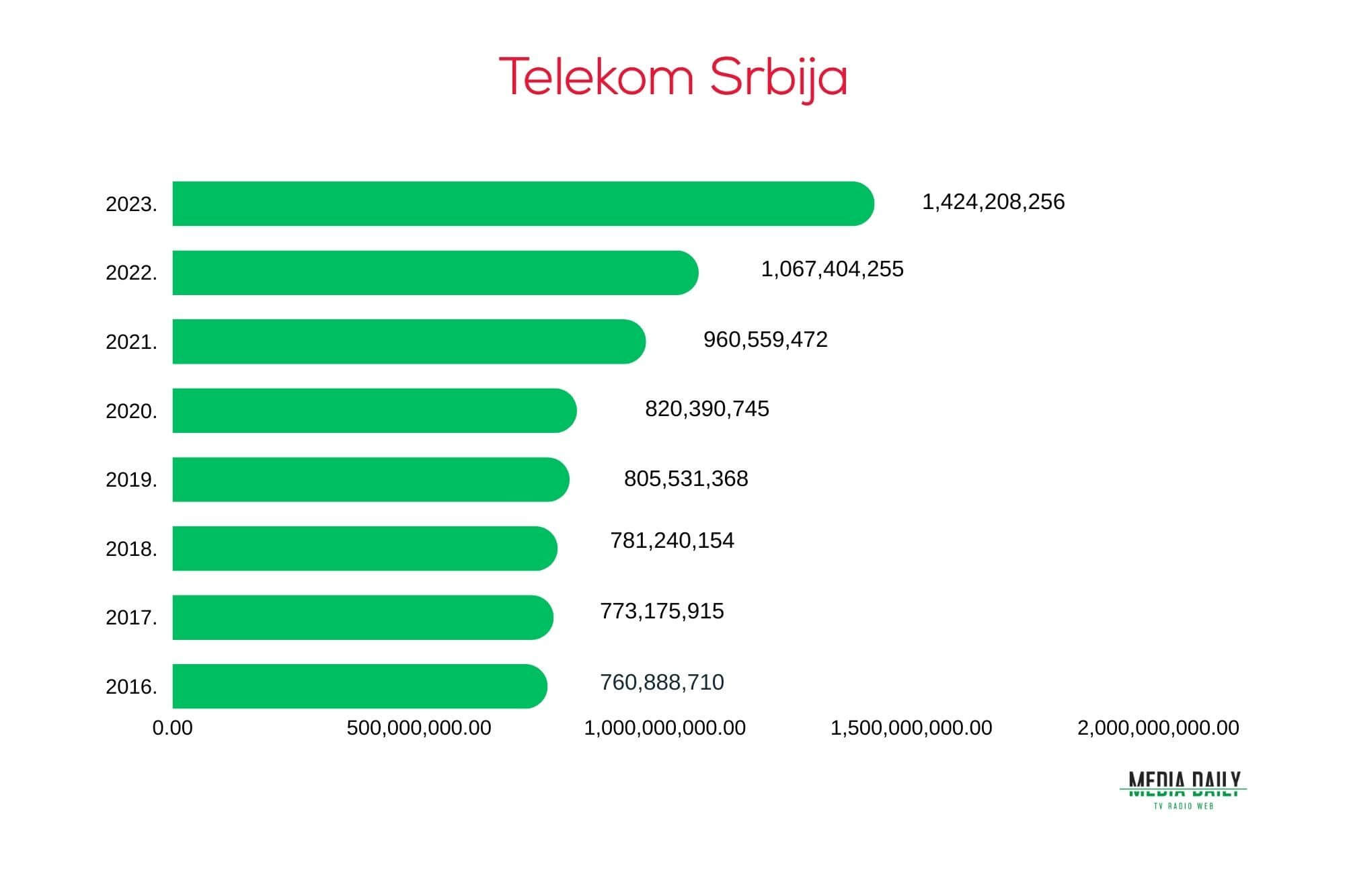

Telecom Serbia (TS) has the strongest growth in revenue and profit. The growth is so great that in eight years, Telecom Serbia managed to almost double its revenues (88% growth), which no one in Serbia, nor the region, was able to do, and we believe that this is a rare phenomenon among telecom operators in Europe as well.

TS has grown so strongly with revenues that the remaining three big telecom players (Yettel, A1 Serbia, and SBB) cannot even come close to catching up. When we add together the revenues from the three telecom operators for the year 2023, they still lack more than 267 million euros to reach Telecom Serbia.

Here is how the revenues of Telecom Serbia looked during the period from 2016 to 2023. All amounts in the following graphs are in euros, and the sources of data are credit rating agencies Dun & Bradstreet, Company Wall, and official financial data of each company.

In 2023, Telecom Serbia also had an impressive net profit of more than 291 million euros. The private telecommunications competition had a collective net profit of almost half that, only 155 million euros.

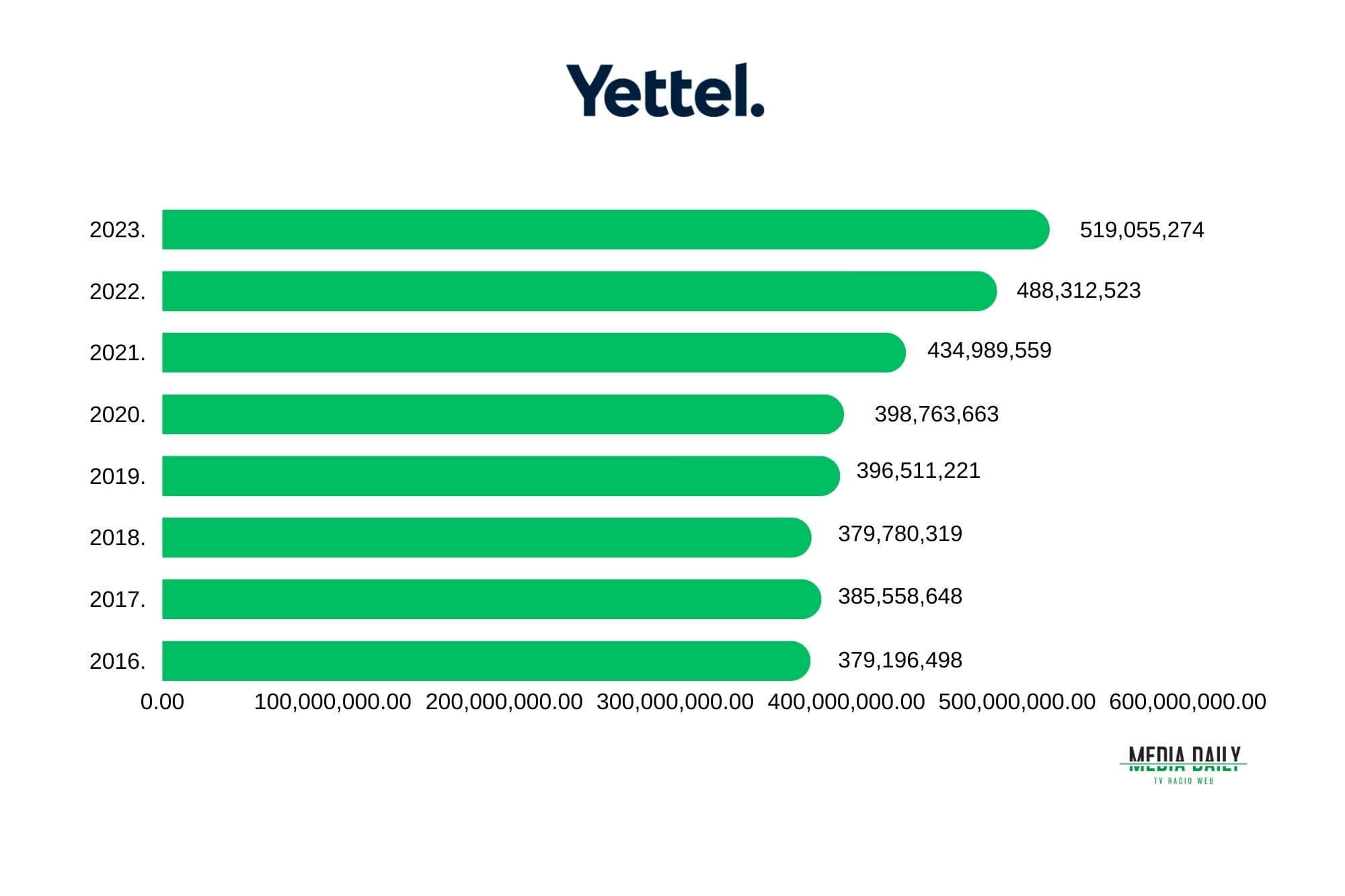

The second strongest telecom operator in Serbia is Yettel, owned by the Czech group PPF, which for the first time in 2023 generated more than 500 million euros in revenue. Its revenue growth in the eight years was still a meager 37%.

The net profit in 2023 amounted to a solid little more than 77 million euros. Here is Yettel’s eight-year revenue table.

A1 Serbia, through the Telecom Austria Group owned by the powerful Mexican telecom operator America Movil, has stagnated with revenues in the last two fiscal years, although it has a total growth in the eight years of 63%.

The net profit in 2023 was slightly more than 45 million euros. You can see how the revenues of A1 Serbia grew from 2016 to 2023 in the table.

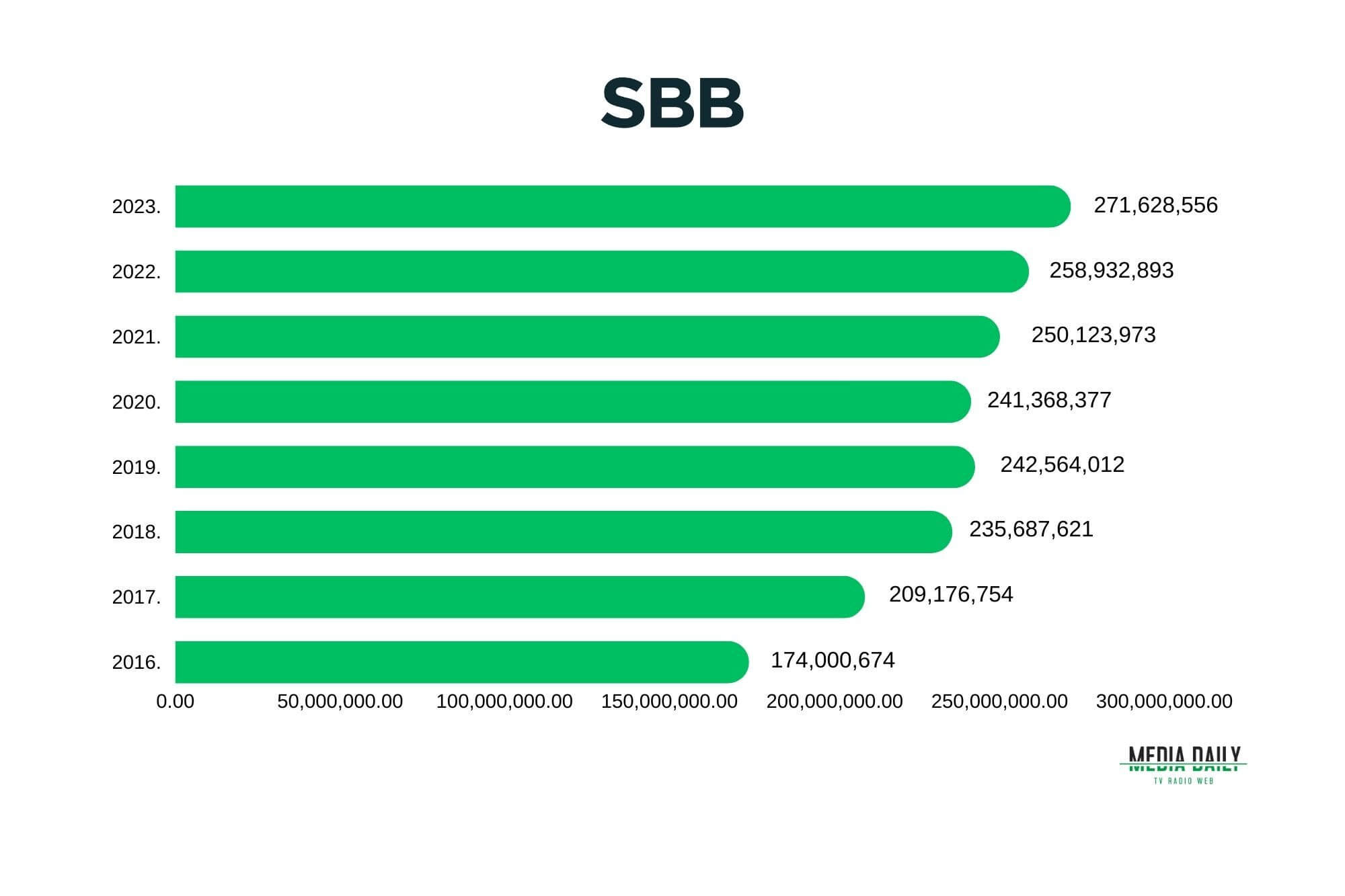

SBB, owned by United Group, has the lowest total revenues of the four large operators, which in 2023 amounted to a little more than 271 million euros. Their income growth over the eight years was 56%.

The net profit of SBB in 2023 amounted to slightly more than 32 million euros and is almost the same in the last few years. Here is a graph with aggregate data of SBB’s income for eight years.

Some vocal critics often emphasize that Telecom Serbia is a state-owned company and that it is therefore in a privileged position, but we in this region are more familiar with the notion of state-owned companies as those that are poorly managed, that do not progress and that do not expand in the region, which is certainly the complete opposite of what Telecom Serbia is doing.

As good chroniclers of events in the region’s telecom market, we can state that we have just such worse examples of state-owned telecom companies in Slovenia (Telecom Slovenia) and Bosnia and Herzegovina (BH Telecom) whose revenues stagnate, are not well managed, and have no expansion strategy. For example, Telecom Slovenia had revenues of 677 million euros in 2016, and only 611 million in 2023. In 2016, BH Telecom generated 279 million euros in revenue, and last year 271 million euros.

It is more than clear which of the two is better!

In the coming days, in the continuation of this text and as an introduction to the announcement of TOP 20 telecoms in the region 2023, we will analyze what the average gross monthly salaries are among the largest telecom companies in Serbia.

Serbia

Serbia

Slovenia

Slovenia Europe

Europe

Croatia

Croatia